From the lacklustre performance of green funds, regulatory changes, political debates around ESG in the US to the cacophony of rating agencies: responsible investing is increasingly like navigating a maze. Trying to find your way by changing direction every time you hit a wall, yet knowing fully well that the only way out is going through it. Responsible investing is here to stay and there are simply too many social and investment issues at stake to leave navigating the maze to chance.

This paper draws on expert analysis from two key, complimentary sources: RIBI™ (the Responsible Investment Brand Index), which highlights the ability of close to 600 asset managers globally to translate their efforts towards responsible investment into their core brand; and Broadridge’s extensive Fund Buyer Focus database – the source behind the renowned annual Fund Brand 50 report – which examines the intrinsic relationship between brand and fund sales.

Together, we demonstrate how responsible investing is inextricably linked to the identity and culture of an asset management firm and how asset managers can build stronger positions by being clear about who they are, what they believe in, and why they do what they do. These questions demand well-thought out and clearly, consistently communicated answers. The RIBI data shows that those asset managers who do this well are more successful than their peers, while Broadridge’s Fund Buyer Focus ESG ranking reveals what success looks like.

In an industry where a plethora of ESG claims, labels and standards have become commonplace to the point that all credibility risks being lost, the narrative of asset managers must evolve, too. As Jack Welch, former CEO of General Electric, aptly said “Control your own destiny or someone else will.”

For asset managers, having a brand that effortlessly embeds your responsible investing convictions is terrific. Establishing whether this solid responsible investing brand foundation is reaching your target audience can prove rather more of a challenge. This is where the Broadridge fund brand ranking can help asset managers determine if indeed they are successfully bridging the gap between perception and reality, in the hard-fought battle to win over clients.

Using Broadridge’s extensive, global Fund Buyer Focus (FBF) database and drawing on the long-standing series of Fund Brand 50 (FB50) studies, now in its 13th year, we have carried out some in-depth analysis of ESG rankings, including looking for correlations with RIBI™, to bring together these two complimentary perspectives on responsible investing in asset management.

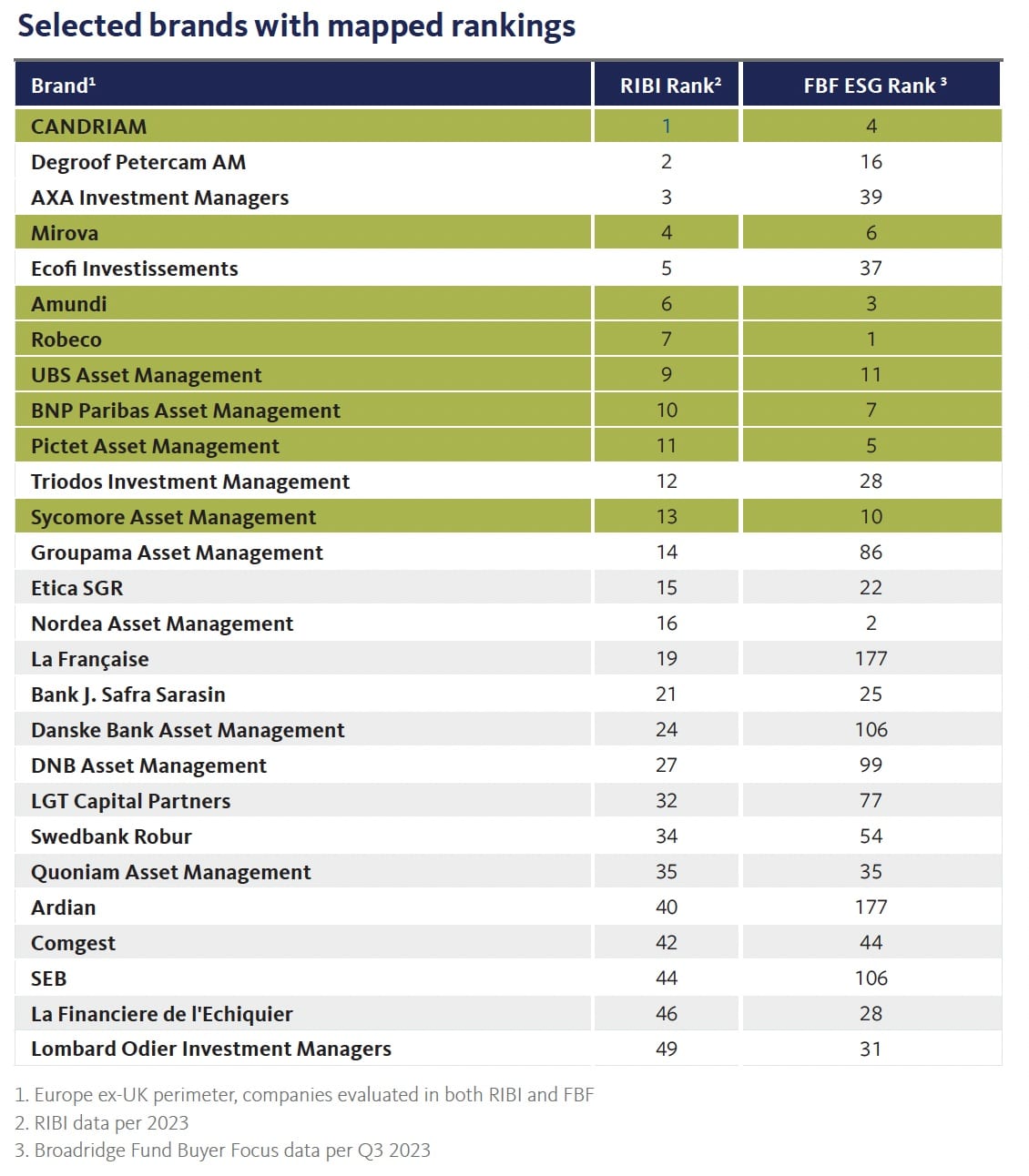

The table below shows the correlation between the latest top-50 RIBI names and those asset manager brands with a ‘mapped’ ESG ranking per third-quarter 2023 FBF data. The eight names highlighted in green below represent managers who appear in the top 15 of both sets of rankings.

Why responsible investment convictions should be part of the brand

To most asset managers, the logo is about as far as the word ‘brand’ goes. However, and while visible to everyone, it is but the tip of the iceberg. Consider the very root of

the word itself: to ‘brand’ something is an age-old concept meaning to mark and hence identify an underlying asset. But if asset managers want to write their own narratives and plans, then we must look deeper. It is the brand that differentiates something or someone from the competition, it inspires and instils trust, simplifies choice by reducing risk, stimulates demand and creates pricing power and, if executed with diligence and consistency, builds loyalty and creates lasting value over time.

The innate meaning of brand in this context is an ecosystem that embodies the collective identity, the culture, and the very soul of an asset manager. At the heart of it lies a raison d’être that energises the corporate heartbeat, propelling individuals to engage with vigour in their daily pursuits, and it forms the magnetic force that aligns an ever more diverse constellation of stakeholders, from clients to suppliers, partners to board members – and increasingly to society at large – around a shared journey.

If purpose is at the heartbeat of a brand, then values are the force that gravitate around it. Properly thought-through and articulated value systems are crucial for asset managers. They establish a strong foundation for decision-making, promote a positive company culture, build trust, propel ethical practices, drive employee loyalty, and attract customers who share similar beliefs. By adhering to core values, asset managers can navigate complex situations with integrity, ensuring long-term sustainability and success. This alignment of values between a business and its stakeholders not only enhances reputation but also contributes to differentiation, and hence competitive advantage in the marketplace. In short, values are not just ethical guidelines but strategic assets that shape the identity and direction of a business, informing strategy, shaping products, and crafting the narratives that echo in the marketplace.

For asset managers, the commitment to responsible investment must be more than a footnote; it must be delicately intertwined with the core of its brand. Here is where RIBI™ (the Responsible Investment Brand Index) comes into play. Celebrating its sixth year, RIBI™ is the litmus test for some 600 global asset managers, gauging how effectively they infuse their responsible investment convictions into their brands.

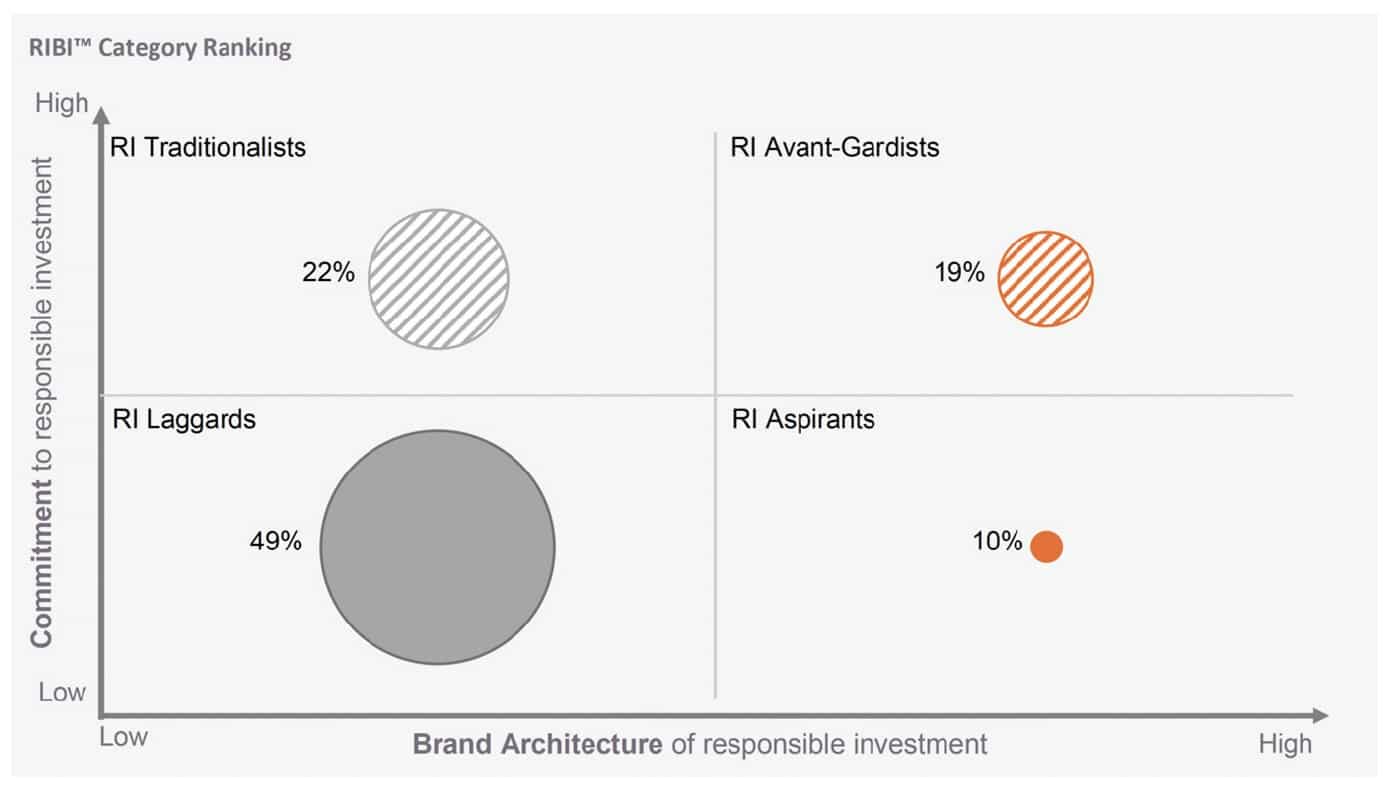

As the chart above shows (using top-level results from the most recent 2023 edition of RIBI), the Avant-Gardist is a demanding category, reached by only 19% of industry players. Geographical differences hide behind these high-level results, which we invite you to discover on the RIBI website.

Now, for those players who do well in RIBI, let us see how they can ensure that their genuine, differentiate identity indeed reaches their target audiences.

How perceptions meet reality – or don’t

For asset managers, having a brand that effortlessly embeds your responsible investing convictions is terrific. Establishing whether or not this solid responsible investing brand foundation is actually reaching your target audience can prove rather more of a challenge. This is where the Broadridge fund brand ranking can help asset managers determine if indeed they are successfully bridging the gap between perception and reality, in the hard-fought battle to win over clients. Using Broadridge’s extensive, global Fund Buyer Focus (FBF) database and drawing on the long-standing series of Fund Brand 50 (FB50) studies, now in its 13th year, we have carried out some in-depth analysis of ESG rankings, including looking for correlations with RIBI™, to bring together these two complimentary perspectives on responsible investing in asset management. The table below shows the correlation between the latest top-50 RIBI names and those asset manager brands with a ‘mapped’ ESG ranking per third-quarter 2023 FBF data. The eight names highlighted in green below represent managers who appear in the top 15 of both sets of rankings.

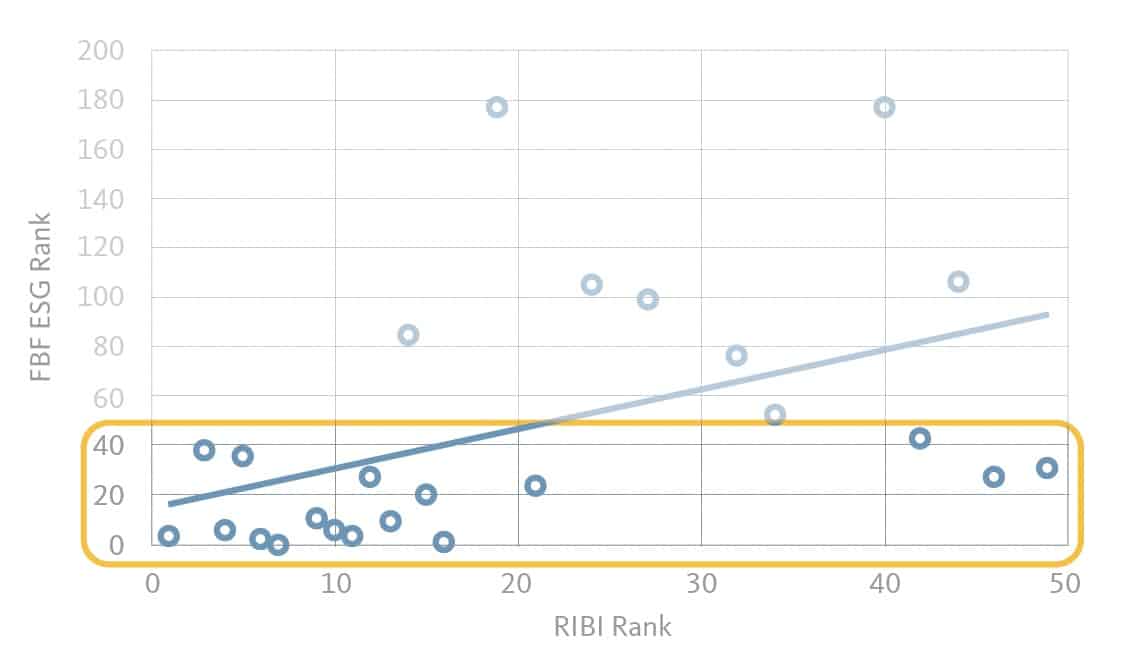

Success in the RIBI ranking reflects where managers are doing the right thing as regards responsible investing and how they articulate this in their brand. A closer look at the overlap between the top-50 RIBI list and top-50 FBF ESG names with a mapped ranking reveals a degree of correlation – i.e. 19 out of 25 mapped rankings correspond (however, this reduces to just 19 out of 49 when we consider the full RIBI list).

There are several reasons as to why these anomalies exist, but in essence the core of the difference boils down to how asset managers implement their brand activation – both internally and externally. To get your external brand perception right, you first need to gain the overriding buy-in from all your internal stakeholders. What better marketeers can you have for your brand externally than employees who truly believe in your clearly defined brand identity, and when this is reflected consistently across all touchpoints: client experience, digital identity, content strategy, PR, etc., etc.

But why does this matter, and what does success look like?

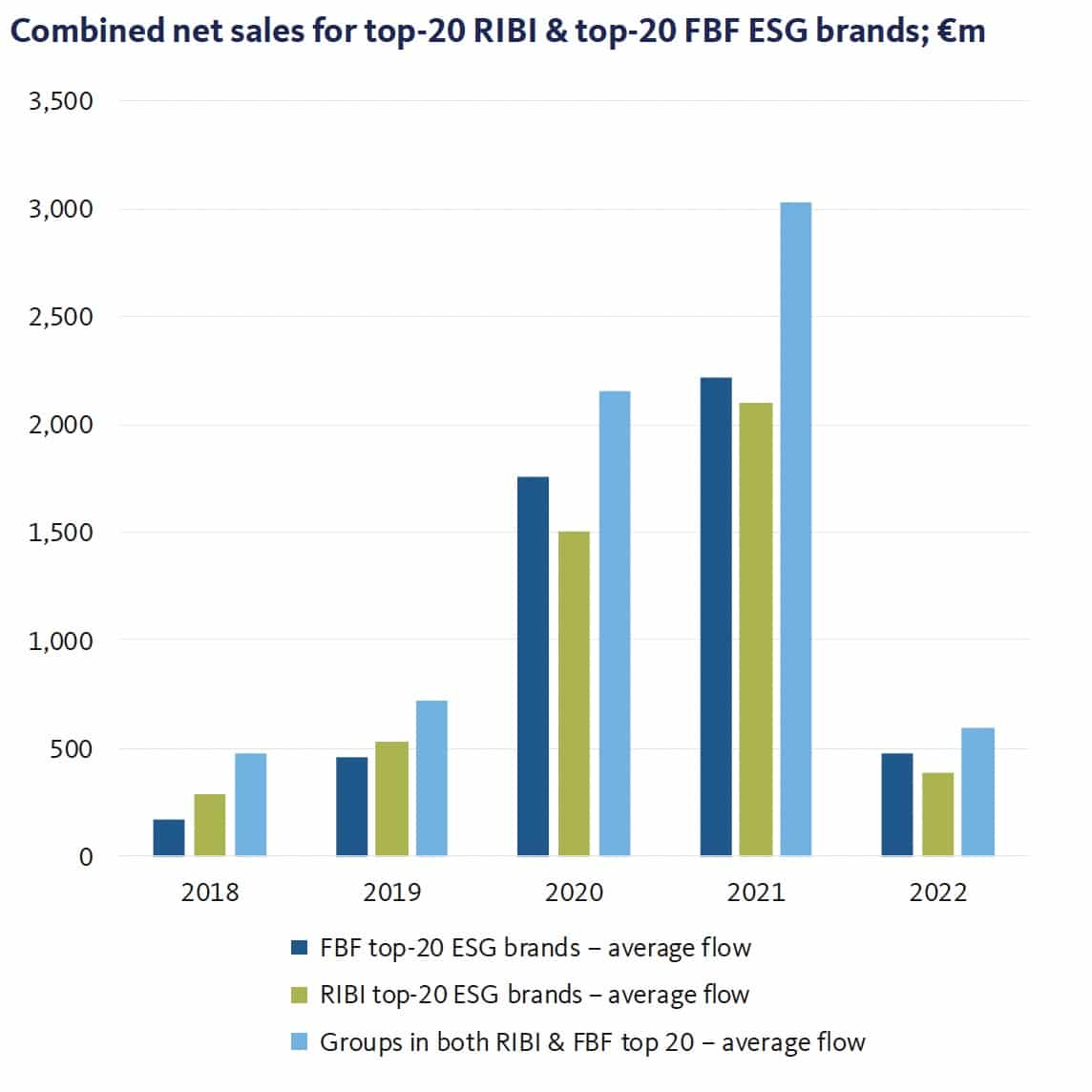

To illustrate just why this matters we took a look at the combined net fund sales flow statistics of the top-20 RIBI brands and the top-20 FBF ESG names, between 2018 and 2022. Here we can see that both sets have strong positive flows on average. Furthermore, the brands most overtly regarded as being ESG (FBF) are seen to outsell, in three of the five years considered, those with a strong foundation (RIBI) – underlining that it is not only important to have the right message, but also getting it across really matters. Even more important is ranking highly for solid foundations (RIBI) and ranking highly for perception (FBF), as that is the dominant bar on the chart.

We believe there are two cornerstones to (commercial) success with a responsible investing brand: clarity and consistency. Clarity is all about your brand content and how you articulate it. It is about deciding what you stand for – and, as importantly, what not – and then building on that brand foundation. Consistency also has its roots in solid, well-thought-out brand content, which is then strategically and systematically executed both internally and externally. Focusing on well-aligned brand development will yield significant benefits to asset managers.

Conclusion

So what makes a good ESG brand, and what does it look like? Above all, the most important characteristic of a really good ESG brand is that it can be felt, it is ‘alive’, it deeply resonates with the company’s core beliefs. Or, in the words of Peter Drucker, when “culture eats strategy for breakfast”, it is truly felt by everyone: employees, customers – and most importantly, the board. Achieving this level of integration requires the active involvement of the board and senior management.

Every investment firm, like every individual, has a unique history and set of beliefs. Expressing this unique identity requires an in-depth exploration of the brand that sets the firm apart in an industry as competitive as ours, with 13,000 asset managers1 vying for attention (and clients) worldwide.

The brand then needs to be activated consistently and systematically across all touchpoints with the target audience. Effective activation depends on a strategic plan that builds consensus among internal stakeholders and aligns commercial objectives with available resources.

To ensure that you are not only achieving your goals, but also outperforming your competitors, it is crucial to objectively measure your progress and relative strengths. In these areas, it can be tempting to make decisions based on subjective or biased information. However, relying on fact-based, well-documented metrics enables sound and informed decisions to be made.

This is where RIBI and FBF can help by objectively measuring your brand’s performance, from content to market perception and understanding. While this may seem like an extensive undertaking in terms of effort, budget and resources, our experience of working with clients on these initiatives shows that it is not as daunting as it may seem. When approached with an efficient methodology, the benefits far outweigh the costs.

Our research shows that those who excel in this area have a greater ability to raise capital than their peers. Furthermore, working on brand identity touches on the strategic identity of the firm, resulting in more than just a brand transformation.

So the question is: when will you start?

DOWNLOAD BR-RIBI WHITE PAPER – PDF