PRESS RELEASE – Zurich, 28 March 2023

- The Responsible Investment Brand Index RIBI™2023 evaluates close to 600 asset managers globally on their ability to translate commitment to responsible development into their brand.

- Both key RIBI ratings (Commitment and Brand) demonstrate good progress towards embedding responsible investment principles by the industry overall.

- Analysis at the country level and at the asset manager level show more diverse results.

Zurich, 28 March 2023. Despite the prevailing geopolitical and economic uncertainty, the Responsible Investment Brand Index RIBI™ 2023 shows positive progress on both key RIBI dimensions: the Commitment rating increased to 2.12, whereas the Brand rating increased to 1.90 – indicating continued uplift of responsible investment practices as well as stronger efforts by asset managers to express this through the brand.

Acknowledging progress and identifying opportunities for further action.

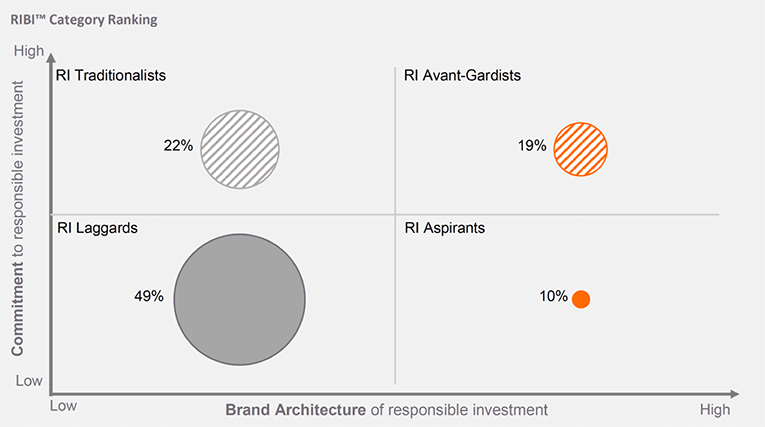

The top category of RIBI Avant-Gardists remains fiercely competitive, with only 19% of companies entering this coveted category (above-average on Commitment rating and Brand rating).

For the first time, just over half of all asset managers express a raison d’être (‘Purpose’), but still only less than a quarter link it to societal good. Markus Kramer, Co-Founder of the Responsible Investment Brand Index, partner at boutique brand consultancy Brand Affairs and author of The Guiding Purpose Strategy, A Navigational Code for Brand Growth puts it into context:

“Purpose plays in an increasingly important role in a complex and accelerated, interconnected world. It provides an anchor of stability in times of uncertainty and acts not just as a unifying force for good, aligning belief and value systems within organisations, but consistency drives growth from within – Purpose and profit can co-exist.”

However, and although positive, the emerging picture remains fragmented. While Europe remains firmly in the lead on both dimensions, North America continues to drift further away. Given the USA remains the largest region in terms of both players and total assets under management, commanding the lowest Commitment rating (1.66) of any region is a reason for concern.

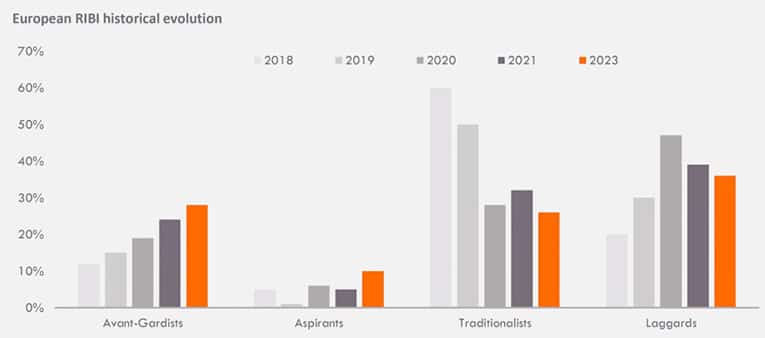

Global perspective: European asset managers are leading the way.

The European asset management industry is on a steady path of improvement, with the Avant-Gardists now representing 28% – more than a quarter of the players (vs. 24% last year). European firms in the industry have now reached such a level of maturity in responsible investment that they feel confident to put their convictions at the very heart of who they are – their brand.

- Candriam

- DPAM

- AXA Investment Managers

- Mirova

- Impax Asset Management

- Ecofi Investissements

- Schroders Investment Management

- Amundi

- Robeco

- CPR Asset Management

It comes perhaps as no surprise that all companies in the global top-10 are European, continuing a broader trend identified in the previous RIBI editions. More interestingly, the global top-10 is made of both gigantic organisations and small boutiques. In other words: responsible investment success primarily depends on the convictions and beliefs guiding management decisions, rather than the size of the organisation.

Jean-François Hirschel, Co-Founder of the Responsible Investment Brand Index, and CEO and Founder of H-Ideas, a company specialised in strategy and positioning in the financial industry adds:

“While we do observe a divide within RIBI across the global regions, the main challenge the financial industry needs to address is its reputation – the need to establish long-term, trusted and mutually profitable relationships with multiple stakeholders. Asset managers are increasingly in the spotlight and focussing on the connection between the financial industry and its societal responsibility through a genuinely expressed brand is a powerful way to achieve this.”

RIBI includes specific perspectives and a top-10 ranking on a country-by-country- level, as well as a focus on boutique managers. The full 2023 Responsible Investment Brand Index, methodology and further information is available at www.ri-brandindex.org.

/// Ends ///

Media contact

RIBI™ c/o Brand Affairs AG, Mühlebachstrasse 8, 8008 Zurich, Suisse

+41 44 254 80 00, pablo.morales@brandaffairs.ch

About the Index

The Responsible Investment Brand Index (RIBITM) identifies which asset management companies act as responsible investors and commit to sustainable development to the extent that they put it at the very heart of who they are, i.e. in their brand. It aggregates the analysis of nearly 600 asset managers listed in the Investment & Pensions Europe Journal Top 500 ranking as of December 31, 2021. For a detailed description of the methodology, please refer to the website www.ri-brandindex.org .

À propos des auteurs

Jean-François Hirschel is the founder and CEO of H-IDEAS, a company which focuses on re-establishing trust in the financial world. His professional expertise lies in strategically positioning financial services companies at brand and product level. Hirschel has held senior leadership positions at Paribas, Société Générale and Unigestion. He holds a MSc from EPFL Lausanne, Switzerland, and has profound knowledge and experience in Institutional, Private and Retail Banking & Asset Management.

Markus Kramer is a partner at Brand Affairs, a specialist consultancy with expertise in strategic positioning and brand building. He holds an MBA from the University of Oxford and is a visiting Senior Fellow in Strategic Brand Management at Bayes (formerly Cass) Business School London. Kramer is author of the book The Guiding Purpose Strategy, A Navigational Code for Brand Growth.