Many successful institutional asset managers are asking themselves whether they should add retail distribution to their armouries. If they take the decision to go into retail, how should they approach the critical challenges of identifying the right distribution channels; establishing the right operational structure for retail sales and anticipating retail market trends?

Why expand into the retail market?

Asset managers are increasingly turning to “retail distribution”. What factors are behind this shift?

- In developed countries, governments are increasingly placing the burden of saving for retirement on the shoulders of their citizens, thus significantly expanding the size of the retail market.

- The margins in retail asset management are higher than in institutional. Profitability across retail and institutional asset management is being squeezed by increased operational costs including higher regulation, more reporting and diminishing fees. Net revenues at asset managers as a share of assets under management were down to 26.5 bps in 2017 from 29.7 bps back in 2013 and close to 35bps before the global financial crisis1. With the lower fees in institutional, it is becoming harder to sustain an “institutional only” business.

- Developing your firm’s reputation in the retail market improves your brand recognition, which makes you intrinsically more visible in the institutional market as well.

Three challenges

In our experience, those asset managers who build a sustainable retail business have successfully tackled three challenges. These are: selecting which retail distribution channel(s) to target; establishing the right marketing infrastructure and anticipating then responding to future retail investment trends.

Which retail distribution channel?

The overall retail market is segmented into several distinctive distribution channels including:

- Banks

- Insurance companies (unit linked contracts)

- Platforms

- IFAs

- Direct to consumer2

Which is/are the most appropriate channel(s) for you and can you distribute your funds through it/them?

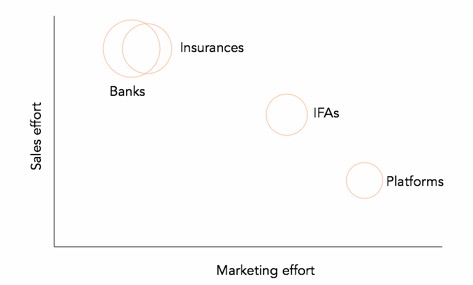

This diversity of distribution channels offers multiple opportunities to build your business but each channel demands a tailored marketing strategy. For example, the needs of a bank distribution network with thousands of employees advising the final investors differ substantially from the needs of an IFA whose small teams of advisers know clients individually whilst marketing a fund through an investment platform with no human interaction requires yet another marketing approach.

Three core strengths

There are three core strengths you will need for success in the retail market and to forge strong relationships with all types of distributors:

- A winning retail product, one which enables investors to enjoy progressive growth in their investment and some protection from severe market conditions. Institutional investors are more interested in investment process and philosophy and are less affected by short-term performance slumps than retail investors.To illustrate, if you have a global equity strategy and the markets drop by 20% and your fund by 10%, the long term institutional investor is likely to view this as a good result on a relative basis whilst a retail investor may feel this more acutely. Winning retail products are therefore those which are designed to suit the retail mindset. Retail asset managers need to provide appropriate education, communication and commentary to explain fluctuations in fund performance. In short, retail success is more holistic and depends on the performance not just of your investment professionals but also of your marketing, communications, sales and customer service teams.

- A strong brand and reputation. This facilitates the sales process and puts your funds at an advantage when distribution channels are selecting new products. This is especially the case with fund platforms, where individual investors choose funds without any personal advice and where brand recognition is an important driver of fund choice. For example, you can invest considerable effort registering your fund on a fund platform with high numbers of funds on it but if your brand is unknown and/or you don’t promote it actively, you will not be visible. There are 54,000 funds in the European market alone3. Even if your performance is top decile, that leaves more than 5,000 competitors. It takes a lot to stand out from the crowd.

- A smooth operational process for your distributor including order management, reporting and fund registration. With MIFID 2, the distributor now bears a lot of advisory risk and needs to have specific information, in the required format and within deadline. From your distributor’s perspective, this is not mere window dressing but is essential for their risk management. For example, I recently interviewed the head of a major European banking distribution unit with 3000 approved funds managed by 500 different providers who explained that if asset managers are unable to send data on their funds and share classes, in the requested file format and timeframe, the provider will be removed from the approved list, regardless of the product quality.

Size of circle represents approximative relative size of distribution channels in Europe.

It’s not just sales!

Retail distribution is about much more than simply establishing a good sales team. You need to support sales activity with a team of marketing, communications, legal, operations and IT experts. You then have to coordinate and align them to reach clearly defined and shared goals.

Key to success is deciding what not to do as well as what to do. Registration costs are increasing. Your distributors want to manage their advisory risk. Having 30 different fund share classes and registering them in every country on a “just in case” basis is a game of the past. It’s simply too costly and risky in today’s world.

Anticipating retail market trends

What does the retail fund distribution hold? Could it be disrupted by tech giants such as Amazon, Facebook and Google?

Facebook tried recently to create a partnership with JP Morgan to access their clients’ banking information. Whilst JP Morgan refused it, there are likely to be other initiatives taken by new economy companies seeking to deepen and leverage client information to generate revenue from financial services.

Will these new players launch their own banks, fund management units or fund distribution platforms? How can you futureproof your retail business against potential new entrants and market transformation? The most powerful way to create a sustainable, disruption-resilient and growing retail business is through brand, reputation and delivery.

Conclusion

The decision to approach the retail distribution channel is an important one. Success means understanding your company’s core strengths then matching them to the most appropriate retail channel distributors. Selling to retail distributors requires a solid and co-ordinated operations support infrastructure including marketing, communications, legal, regulatory and IT operations.

Investing in and developing a brand for the retail market will have a positive effect on your institutional business. It will also be helpful in future-proofing your company as it will differentiate your company from its current competitors and the potential arrival of the tech giants.

The retail market offers a tantalising new playground for institutional managers. Understanding and following the rules of the game will ensure you’re on the winning side.

2 Distribution structure as shown in “Distribution systems of retail investment products across the European Union – Final Report” – European Commission – April 2018 – For readability purposes, “Robo / Automated Advisor”, “On line fund supermarket”, “Online discount broker”, “Social Trading Platform” have been grouped under the generic category “Platform”.

3 “Worldwide Regulated Open-ended Fund Assets and Flows – June 2017” – EFAMA, European Fund and Asset Management Association.