In today’s globally connected and complex economy, true differentiation on a product or service level is getting ever harder to achieve – not everyone is Apple. Even Tesla is starting to struggle as the incumbent automotive players are catching up with producing similar, if not better, electric cars. For most business leaders, the recognition is one of consternation: most products and services today are identical or marginally differentiated at best. The age of creating truly unique selling propositions is long gone. The Finance industry is certainly no exception, despite innovations pushes, crypto-currencies and mushrooming fintech propositions.

Purpose, the use of a company’s reason why, can genuinely spur and foster competitive advantage and performance. Perhaps not obvious at first sight, doing well (financially) and doing good are not opposites. The objective of this article is to unpack the power of Purpose for the finance industry more broadly and for the asset management industry specifically, looking through the lens of our Responsible Investment Brand Index (RIBI™) 2020.

Asset Management is uniquely placed to genuinely think about societal Purpose

The asset management industry is at a pivotal stage. On one hand, there is no doubt that this is an industry that believes itself judged by numbers only – e.g. by the financial returns the managers generate on the assets their clients entrust them with. On the other hand, there is a growing recognition that positive returns can no longer just be measured in absolute monetary returns and hence this cannot serve as a competitive differentiator. A solid performance is considered an entry ticket. With 4400 investment managers and 63000 funds in Europe alone1, investors are not short of choice. Yet they don’t want more choices; they want more certainty in the choices they make. And this in turn, is tied to belief-systems investors can genuinely associate with. Consequently, companies and teams that are entrusted with the managing of assets are increasingly scrutinized not just for their ability to do good, but also their demonstration of a spirit and culture that places societal returns at equal levels to deliver growth.

This duality of demand towards asset managers on generating positive returns on both assets under management as well as on society at large represents no easy feat by any means. However, we believe that the asset management industry is actually uniquely placed to embrace this challenge. This is due both to what asset managers do for their clients (end-investors) as well as to the nature and the reach of the products they manage.

What they do for the end-investors is, for example, helping the latter reach financial security at retirement. Which, considering the demographic structure of our world, represents a huge social responsibility. The products they manage have a powerful social impact: funnelling assets to and from companies galvanises the economy, redirects its emphasis and creates jobs. Increasingly, this has a direct bearing on environmental, social and governance matters.

Is societal Purpose endorsed by asset managers?

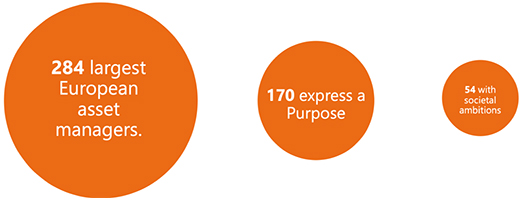

In our work on the Responsible Investment Brand Index (RIBITM), the only index in the market which measures the connection between what asset managers do in terms of Responsible Investment and how they project this in their brand, we have found that there is still a clear lack of embracing the duality of thought rooted in the combination of monetary return and societal Purpose2. Our analysis of the 284 largest European asset managers depicts a telling story: 52% express a Purpose [of some sort], yet only 19% also do so by connecting it deliberately with societal responsibilities at heart

Expressing a Purpose linked to societal good is not enough, however. In order to substantiate our concern, we also need to take into the consideration the duality with which a Purpose is expressed.

Getting the quality of Purpose right

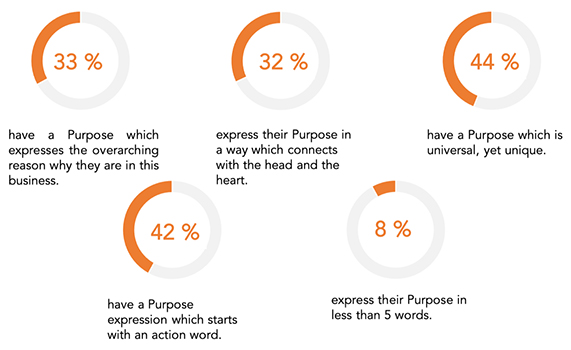

We rely on our own research and experience3 of working with many brands across different sectors and geographies in order to provide as a proxy of what constitutes a good Purpose. Our methodology is based on five yes / no criteria with the objective of allowing for as much objectivity within an inherently subjective matter, thus leading the path to meaningful benchmarking.

The criteria are as follows:

- The Purpose expresses the overarching reason why: yes / no

– We look for descriptors and language that expresses a reason for being in business in the first instance. This generally allows engagement, alignment and activation. - The expression of the Purpose connects with the head and the heart: yes / no

– A strong Purpose statement needs to connect both with the emotional and logic appreciation of stakeholders. - The expression of the Purpose is universal yet unique: yes / no

– We look for appreciation of the broader context a company operates in. At the same time, Purpose needs to be tied to points of differentiation and link to a firm’s positioning. - The expression of the Purpose starts with an action word: yes / no

– Based on decomposing hundreds of powerful Purpose statements, we have found that effective Purpose statements work best when action oriented. - The Purpose is expressed in less than five words: yes / no

– An effective Purpose is framed contextually and will not require long or lofty wordings. This is to make sure stakeholders can easily remember and ‘pass on’ the spirit of a company’s reason-why.

Much needs to be understood and to be done yet

At the top level, the average “quality of expression of Purpose” rating of the 52% of the asset managers in the RIBI 2020 universe who do express a Purpose stands at 1.57, well below our demarcation average of 2.5.

In more detail:

These [low] numbers deserve attention. In our view and experience, asset managers are absolutely capable to think through, design and express a high-quality Purpose; it is just not in their nature (yet) of paying enough attention to this area. Their focus has been and remains on so many other business relevant subjects that the time and attention needed to adopt Purpose as a force for good in business and beyond is compromised. It is not easy and should under no circumstances be taken lightly. Boiling it down to a powerful, driving strength from within requires a delicate balance of structure, experience and dedication. As the mathematician, physicist and philosopher Blaise Pascal already put it in the 17th century, “I write you a long letter because I don’t have time to write you a short one.”

Putting it all together, focusing on those 19% of asset managers who do express a Purpose connecting with societal responsibilities and identifying among these ones those who score above the 2.5 average in the above-described rating scale, we are left with only 10% of asset managers in the RIBI 2020 universe. It is worthwhile drawing out some of the good examples we have encountered.

- « Investing for a better tomorrow. »

- « Creating sustainable value. »

- « Make the world a better place. »

- « To help more and more people experience financial well-being. »

- « Invest responsibly to enable economic prosperity and social progress. »

- « Allocating capital responsibly. »

Some of these put more emphasis on financial aspects than societal aspects, or the other way around. Some of these Purpose statements speak more to the heart than to the brain, or conversely. But this is not the point. The points here is that they all convey a much more inspiring vision and ambition than “generating more money” and they all endorse fully the societal responsibility of an asset manager.

It is very important to note here that any Purpose statement needs to be seen in broader context, especially the embedding of it into a value and belief system that acts as catalyst for activation. Consequently, the Responsible Investment Brand Index takes this this into consideration. We actively look for, and evaluate asset managers, on their value systems also. We will outline this topic and the dynamic it represents in the context of finding, articulating and embedding powerful Purpose statements in our next article. If you can’t wait to explore this further, then the full details of how we rate value systems are available on request and also feature in detail in the INISGHTS+ Reports we provide.

Asset Managers now is your chance!

Over time, genuine and lasting differentiation hinges on a company’s ability to continuously innovate and perform. This is not about a unique product or service, but about building strength through a company’s unique configuration of Purpose, resources, energy and people or in other words, its culture. While distributed IP and globally connected markets allow for ever more rapid replication and scale of products and services, a company’s culture cannot be copied easily. As Prof. Peter Drucker, great management thinker educator put it many decades ago already: ‘Culture eats strategy for breakfast’.

We are convinced now is the time to get this right for the benefit of the asset managers, their clients and the society as a whole. The extremely crowded and therefore competitive nature of the industry is only accelerating. Differentiation, being able to express a unique identity, is therefore of paramount importance.

Some industry actors have taken the increased interest for Responsible Investment as an opportunity to differentiate. This will no longer work as the European Union is enforcing regulations which comes in effect step by step between now and 2023, driving the entire industry to become responsible by law4. And complying with the law is certainly not a differentiator.

The recent health crisis has considerably strengthened the movement towards the importance of societal Purpose. We believe that establishing a clear, transparent ‘reason for being’ (e.g., Purpose) forms part of a broader topic: the much-needed alignment of needs and expectations between investors, those who manage their money and the world at large: something that our society desperately needs at a time when so many long-term issues need solutions. Asset managers, and companies within the financial industry at large, have indeed significant roles to play in how well these solutions will develop.

We therefore recommend a methodical and thoughtful reflection on your Purpose and how to best convey it. So that you radiate with positivity when your clients, their advisors, your current and future talents, your shareholders or even your family googles for it.

March 2021, by Jean-Francois Hirschel and Markus Kramer

1 Source: « Asset Management in Europe – 9th Edition – Facts and figures – May 2019 » – EFAMA, European Fund and Asset Management Association. « Worldwide Regulated Open-ended Fund Assets and Flows – June 2019 » – EFAMA, European Fund and Asset Management Association.

2 Source: Hirschel & Kramer, Responsible Investment Brand Index (RIBI™) 2020, www.ri-brandindex.org

3 Makrus Kramer, The Guiding Purpose Strategy, A Navigational Code for Growth, 2017, 2020, London/New York

4 To be more precise, the regulation is « comply or explain ».

Contacts

Jean-François Hirschel

CEO and Founder

H-Ideas S.A.

Rue de la Cité, 1

1204 Geneva, Switzerland

tel: +41 22 561 8412

e-mail: jf@h-ideas.ch

Markus Kramer

Managing Partner

Brand Affairs AG

Mühlebachstrasse 8

8008 Zurich, Switzerland

tel: +41 44 254 80 00

e-mail: markus.kramer@brandaffairs.ch

Media Contact

Brand Affairs AG, Mühlebachstrasse 8, 8008 Zurich, Switzerland

+41 44 254 80 00, liza.schempp@brandaffairs.ch

www.ri-brandindex.org