I recently attended a conference on ESG. I was impressed by the passion, expertise, and commitment of the speakers. However, I was disturbed by the extent to which they made themselves unapproachable: an endless succession of jargon, acronyms, United Nations Sustainable Development Goals presented with their numbers, assuming that the audience knew the corresponding theme by heart, and so on.

This is reminiscent of hedge fund marketing in the 2000s: terminology and presentation methods adopted by a restricted club of insiders, the impression that a display of cryptic vocabulary will make the speaker look like an expert and convince the listener that he is the right partner.

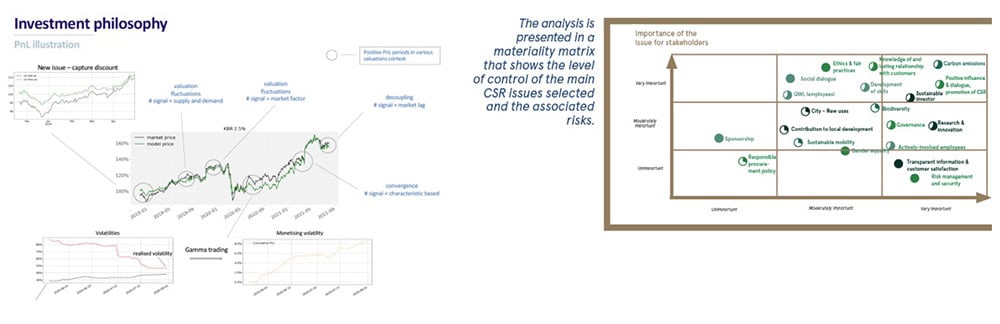

The two exhibits below are taken from a hedge fund presentation on the left, and a responsible investment policy on the right. They share a number of features that make them difficult to understand, and worse, that can lead to misinterpretation. For example: graphs that are unreadable because they contain too much information, cryptic vocabulary (“gamma trading” on the hedge fund side, “double and simple materiality” on the ESG side), and abbreviations (for those of you who are curious, “QWL” simply stands for “Quality of Working Life”).

The rest is history for hedge funds. The global financial crisis of 2008 erupted, and although the asset class accounted for less than 5%1 of the world’s fund assets, hedge funds made headlines by being blamed for the collapse of the markets. Even the most ethical and best-performing hedge funds were indiscriminately blamed for everything that went wrong.

Such a situation would be even more serious in the context of ESG. First, because we are no longer talking about 5% of the world’s assets, but 35%2. Second, and most importantly, because ESG is the connecting thread between finance and society. We are dealing with issues that have a profound impact on our future and that of our children. There is no room for doubt, controversy or scandal.

I therefore call on all those involved in responsible investment to make themselves accessible, understandable and, in a word, human – your subject is so human! This, too, is part of your immense responsibility.

Also in this area of ESG, H-Ideas’ communication beliefs can be of particular use. For example: « The success of a communication is based on what is perceived by the listener, not on what is said by the speaker ».

I would be delighted to discuss how these beliefs can be used to support your ESG messaging and make it even more relevant to your audience.

Please contact me at jf@h-ideas.ch or +41 22 561 8412

2 Idem